As part of its new strategy announced on Thursday, the European Central Bank will consider climate change in its setting of monetary policy, leading to questions on whether it should and how it will do so. And it’s a fair point that the ECB’s tools to fight climate change are limited. What the ECB’s new green mandate may mean, in practice, is not buying the corporate bonds of, say, French and Spanish oil companies when it engages in quantitative easing, which probably won’t move the dial on global climate very much.

A more interesting question is how central banks will react to the economic consequences of climate change. David Friedberg, the founder and chief executive of San Francisco investment firm the Production Board, laid out the investment implications of the worsening drought affecting North America in a tweetstorm. 2020 was the hottest year on record in California, fueling the largest number of acres burned, and temperatures in British Columbia reached Canadian records this year. California’s snowpack, on June 1, was 0% of the average. Zero.

Property, jobs and businesses are at risk, he wrote. “Food prices are inflating, water security is diminishing. Some/none of these risks may manifest, but there are enough nonzero-probability scenarios that aggregate risk of serious catastrophe seems significant,” he said. He speculated that there could be large-scale climate migration from western states to eastern or northern ones, but, even without that, years of growth for on-premise solar and gas generators and battery systems. With workers unable to go outside, construction costs in already housing-starved western states could increase. Another issue, he said, was that a third of housing is at the intersection of forestland, which is prone to fire.

The Fed is only just starting to discuss climate change, and more in the context of financial stability shocks than interest-rate policy. But it’s worth considering how the possibility of tighter labor and housing markets from climate change intersects with a demographic shift. In June, the African-American labor participation rate exceeded the white labor participation rate for the first time since 1972, which reflects the aging of the baby-boom generation. And China, long the source of global deflation, is decoupling from the West at rapid speed, and, even if its government weren’t pursuing that policy, its working-age population is projected to decline.

So the Fed could be in for some inflation-related headaches even if it’s right that current worker and production shortages linked to the pandemic may dissipate. Of course, the current market concern — at least this week — is deflationary, both over the new delta strain of coronavirus that is limiting the global economic rebound from reopening and about how economies will perform when fiscal and monetary policy tightens.

The buzz

More tightening of virus rules was announced across Asia and Europe, with Seoul’s pandemic alert status lifted to its highest level, a tightening of social-distancing rules in Sydney, and the Netherlands taking new steps, just a day after Japan effectively ruled out spectators at the upcoming 2020 Olympics. Pfizer

PFE,

and COVID-19 vaccine partner BioNTech

BNTX,

said late Thursday they are developing a booster shot targeting the delta variant.

Finance ministers from Group of 20 countries are meeting in Venice as they move toward a global minimum tax for corporations, which they’re aiming to finalize by October.

President Joe Biden is on Friday expected to sign an executive order aimed at reining in the power of big business, targeting agriculture, banking, tech, transportation and other sectors.

The People’s Bank of China cut reserve requirements for banks by half a percentage point in a move to bolster the world’s second largest economy.

Philip Morris International

PM,

said it’s buying Vectura Group

VEC,

a maker of inhaled therapeutics, for £1.05 billion ($1.5 billion) in what the cigarette maker said was part of a “natural evolution into a broader healthcare and wellness company.”

ARK Invest sold $54 million worth of streaming-device maker Roku

ROKU,

and $23 million of Chinese internet company Tencent

700,

according to the daily disclosures the active investment manager makes. The ETF manager made sales of similar sizes on Wednesday.

Jeans maker Levi Strauss & Co.

LEVI,

reported stronger-than-expected second-quarter results.

The markets

A resumption of normality after Thursday’s drop in stocks. U.S. indexes

SPX,

DJIA,

opened higher, though the Nasdaq Composite

COMP,

was barely positive, and the yield on the 10-year Treasury

TMUBMUSD10Y,

crept up to 1.34%.

The chart

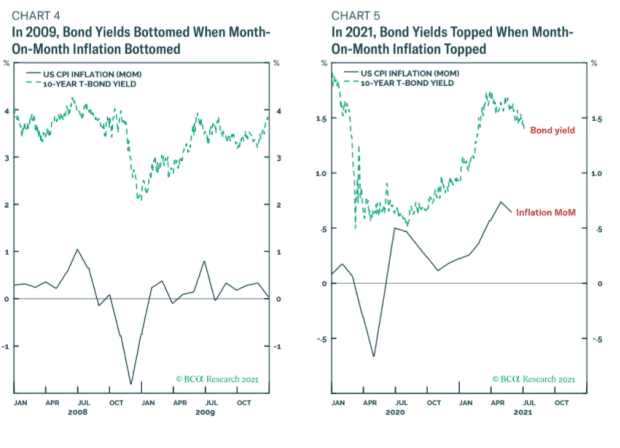

Investors shouldn’t be surprised to see bond yields falling even with inflation well above normal. After all, in 2009, the opposite occurred, notes Dhaval Joshi, chief strategist of BCA Research’s Counterpoint. “So long as the coming monthly prints confirm an ongoing deceleration in inflation, the current rally in bonds will stay intact,” he says.

Random reads

The new spelling-bee champ also has Guinness records for dribbling, bouncing and juggling basketballs.

Scientists have figured out why sea otters are like Alaskan huskies.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern time.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.