Shares of Carver Bancorp Inc. skyrocketed in very volatile trading toward a 10-year high, even though the New York-based bank serving African-American communities apparently has not released any news.

The stock

CARV,

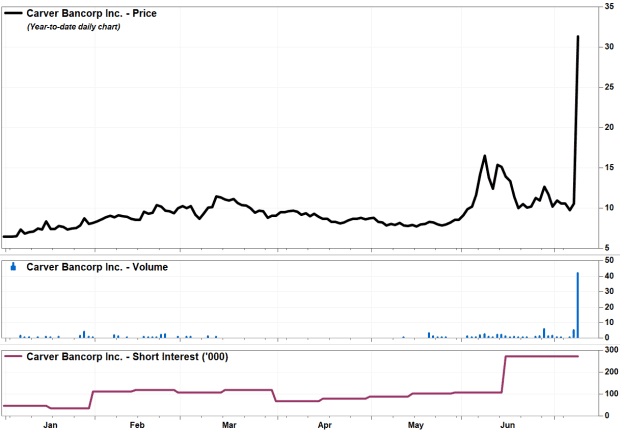

rose 201% in midday trading, paring an earlier gain of as much as 267%, but on track to close at the highest price since February 2011. Trading volume spiked up to 42.0 million shares, compared with the full-day average over the past 30 days of about 1.1 million shares.

Since Thursday’s opening bell, Carver’s stock has been halted 9 times for volatility, all so far between 9:36 a.m. Eastern and 11:16 a.m.

The company did not immediately respond to a request for comment.

Prior to Thursday’s rally, the stock had run up 63% year to date through Wednesday, while the SPDR S&P Regional Banking exchange-traded fund

KRE,

had rallied 22% and the S&P 500 index

SPX,

had climbed 16%.

The last news released by the company was on June 17, when the bank holding company and Bank of America Corp. announced that they had closed on a senior secured social impact revolving credit facility with BlackRock Inc.’s

BLK,

Alternative Solutions Group. Carver said that marked the first it had participated in a subscription line facility.

The last filing with the Securities and Exchange Commission was the company’s 10-K annual report on June 29.

FactSet, MarketWatch

The latest official exchange reading on short interest showed that bearish bets on Carver’s stock nearly tripled in the latest two week period to a record high of 272,367 shares as of June 15, up from 108,725 shares as of May 28.

That pushed short interest as a percent of the public float of shares up to 60.2%. In comparison, short interest as a percent of float was 9.2% for fellow New York-based regional bank New York Community Bancorp Inc.

NYCB,

3.7% for Dime Community Bancshares Inc.

DCOM,

and 2.3% for Signature Bank

SBNY,