Beijing has sent shockwaves through global financial circles with plans to tighten restrictions on overseas listings of Chinese companies, in a development that could threaten more than $2tn worth of shares on Wall Street.

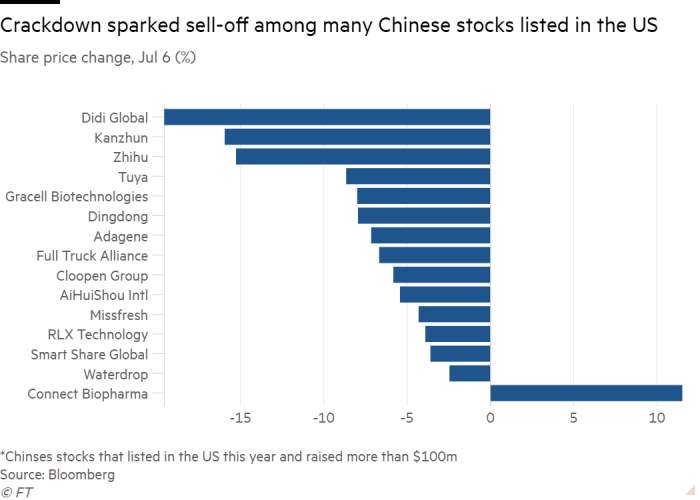

But the vague and sprawling nature of the announcement on Tuesday, which followed a crackdown on New York-listed ride-hailing group Didi, has sown confusion among traders and investment bankers. Chinese companies are already reconsidering US listings, hitting a lucrative trade for American banks.

What has China announced?

The announcement came from China’s top leaders and stated that the reforms were “guided by Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era”.

The guidelines threaten stronger supervision of American depositary receipts, which Chinese groups use to list in the US, and “effective measures to deal with risks and emergencies arising from Chinese ADR companies”.

Yi Huiman, chair of the China Securities Regulatory Commission, called it a “new starting point for the modernisation of [the country’s] system for capital market governance”.

But bankers and experts said the announcement indicated that US listings would become far more difficult for Chinese companies, particularly those whose businesses depended heavily on data — if they were allowed at all.

“Could I see an outright ban on US listings? Yes,” said Fraser Howie, an independent analyst and expert on China’s financial system. He added that the “variable interest entity” structure used by Chinese groups to issue shares in New York could also come under greater pressure from Beijing. These are offshore entities used to get around foreign investment rules in China for certain sectors.

There are nearly 250 Chinese companies listed in New York with a combined market capitalisation of $2.1tn, according to the US-China Economic and Security Review Commission.

What is behind the move?

The guidelines make clear that data are a national security matter, a concern underlined by the launch of an investigation into Didi by the Cyberspace Administration of China (CAC) just days after its $4.4bn initial public offering last week.

One person close to Didi said the company had been advised by the CAC to delay its listing until it had conducted a data security review. Didi denied it knew before its IPO that regulators planned to intervene.

Zuo Xiaodong, a CAC adviser, told local media that a US law passed in December that requires US-listed Chinese companies to submit to American audits could result in important data leaking beyond the country’s borders.

Yet legal experts say there is no law allowing the CAC or other agencies to intervene in overseas listings on data security grounds, hence the need to tighten regulations.

“In the past most Chinese companies listed in overseas markets through an offshore company [a VIE], which is completely out of reach of Chinese regulators . . . In the future there may be some kind of report and review process,” said Luo Zhiyu, a partner at DeHeng Law Offices.

In March, the Securities and Exchange Commission began rolling out rules threatening to delist foreign companies from American exchanges if they do not meet US auditing standards for three years. One person involved in negotiations said the US had rejected a suggestion from China that its regulators conduct the audit inspections and deliver their conclusions to the US Public Company Accounting Oversight Board.

The new Chinese guidelines point to the need to “further deepen cross-border audit supervision co-operation”, suggesting the country remains open to co-operation. But this confounded legal experts. “There’s no ongoing audit co-operation so there is nothing to deepen,” said one US regulatory lawyer.

Paul Leder, a former director of the SEC’s Office of International Affairs who was directly involved in negotiations with China on audits, said the language about co-operation was “encouraging . . . but the real issue is whether they are willing to commit to the kind of direct oversight of foreign audit firms required under US law”.

How big is the impact?

Bankers and analysts said the new regulations could threaten billions of dollars of Chinese technology listings planned for New York, which offers greater market depth than Hong Kong and fewer capital restrictions than Shanghai or Shenzhen.

“There are quite a few Chinese corporates we can see that are definitely rethinking whether they should go to the US . . . issuers are taking this much more seriously,” said the Asia head of equity capital markets at one US investment bank.

“Any deal would have to be done at a huge discount,” said a partner at a leading law firm in the US.

The head of capital markets at a Wall Street bank in Hong Kong said bankers were preparing for a “tough” second half of the year.

Who are the winners and losers?

The biggest losers are likely to be the Nasdaq and New York Stock Exchange, where Chinese IPOs have raised more than $106bn, according to Refinitiv data. These listings have become central to Wall Street banks’ revenues in recent years, with about $24bn raised in the past 18 months.

“For companies with offshore fundraising needs, their best listing destination will be Hong Kong from now on,” said Bruce Pang, head of research at China Renaissance, an investment bank.

The role of foreign venture capital and private equity in funding Chinese start-ups means tech groups will remain under pressure to list outside mainland China, beyond the reach of its strict capital controls.

“For the bigger companies and the [IPOs] that are ready to go . . . you’re going to go to Hong Kong straight away,” said the Asia equity capital markets head.

What happens next?

The guidelines’ broad language means regulators could potentially take a light touch on enforcement but those who spoke to the Financial Times were sceptical.

“Regardless of the direct impact on Didi, listing in the US will now be a cautionary tale for Chinese companies and US investors,” said the US law firm partner.

“There will be a growing number of companies being pressured to delist [from the US] and to do a share buyback and simultaneous listing in Hong Kong,” said Howie, the China finance expert.

He added that the heads of big Chinese tech groups listed in the US could face serious consequences if they resisted any drive to delist. “I would be very worried if I was a Chinese internet baron that I could find myself in a cell.”